← Back to all posts

4 Lessons & Digital Insights from Yesterday’s Antitrust Hearing with Tech CEOs

Yesterday’s hearing by the House Subcommittee on Antitrust, Commercial and Administrative Law was a showdown between House Members and CEOs from Amazon, Apple, Facebook, and Google. Rational 360 crunched the numbers on how these hearings impacted online brand reputation, and identified four top insights for companies facing congressional scrutiny:

Lesson 1: Find a Way to Drive Your Positive Message, Even Against Headwinds

Amazon CEO Jeff Bezos and Apple CEO Tim Cook were largely able to drive some positive messaging into the antitrust conversation — Bezos by touting support that his company gives to small businesses, and Cook voicing equal treatment toward the company’s developers.

When comparing the overall antitrust online conversation throughout 2020 to conversation on July 29, we found that sentiment toward Amazon, Apple and Facebook in the context of antitrust was largely unchanged over its 2020 baseline—but sentiment toward Google in the context of antitrust skewed more negatively, leaping from 77 percent negative in 2020 to 85 percent negative on July 29 as conservative and liberal voices alike took to Twitter to criticize Google’s competition, content moderation and privacy practices.

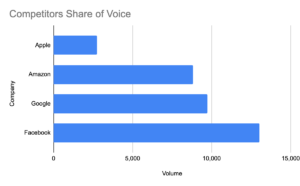

When looking at overall conversation volume, more people posted about Facebook than any other tech company. Mentions of Facebook made up 38 percent of the posts around the participating companies, compared to only 28 percent for Google, 26 percent for Amazon and eight percent for Apple. Much of the online conversation around the hearing has been driven by news articles.

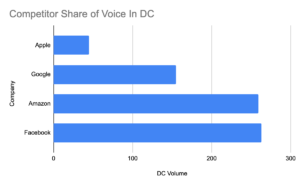

Zooming in on the conversation happening in Washington, DC influencers also posted about Facebook than any other tech company during the hearing – but conversation about Amazon was disproportionately high inside the beltway compared to the overall conversation. This may be an indicator that Amazon could face more headwinds in DC. Mentions in Washington about Facebook made up 37 percent of posts around the participating companies, closely followed by Amazon at 35 percent, 22 percent for Google and six percent for Apple. Much of the online conversation around the hearing has been driven by notable reporters with national publications.

Lesson 2: Members of Congress Drove Their Narrative Online, Regardless of The Questions and Answers from the Hearing

Members of Congress on the House Judiciary Antitrust Subcommittee were naturally highly engaged in the online conversation. Members of Congress who were active in the online conversation published a total of 25 posts that were opposed to the tech companies. Rep. Pamilia Jayapal (D-WA), who represents a district in Amazon’s Seattle backyard, was persistent in questioning CEO Jeff Bezos about the company’s use of third-party seller data for its own business decisions—in the hearing and online. Her one original tweet and 11 retweets (of both news outlets and other Members quoting her remarks) reached more than 34,000 Twitter users.

Lesson 3: Being Proactive Can Pay Dividends

Among the tech companies whose CEOs testified, Apple received fewer questions around antitrust. CEO Tim Cook has previously been vocal in policy conversations about digital security through statements about urging stricter data privacy regulations and through ad campaigns. According to VentureBeat, Apple was questioned just seven times, compared to Amazon’s 13 times, Facebook’s 16 times and Google’s 16 times. This differential in questioning was reflected in the overall online conversation, as mentions of Apple on social media was low in comparison to its competitors.

Lesson 4: CEO Clout Amplifies Online Conversation

Compared to the February 2019 Senate Finance Committee on Drug Pricing with CEOs from several major pharmaceutical companies, this hearing generated around 15 times more online conversation. CEOs who testified in the drug pricing hearing are not as well known among mainstream media compared to CEOs from the tech industry, whose practices—and wealth—are often discussed in mainstream media and consumer product conversations.

About

Rational 360 analyzed the online conversation around the 7/29/2020 House Judiciary Antitrust Subcommittee hearing to identify potential implications for companies facing similar scrutiny. As part of the analysis, Rational 360 used a custom string of relevant keywords and phrases to look at online news publications, blogs, Twitter, Reddit, forums, online comments, Instagram, reviews and YouTube posts from members of Congress, activists, policy experts and general online chatter.

Stay In Touch

Complete the form to stay up-to-date with Rational 360 news.